Tokenomics 101: The Fundamentals Every Crypto Investor Should Know

In the world of cryptocurrency, hype can push a project into the spotlight—but only strong fundamentals keep it there. Among the most important fundamentals is tokenomics. Often overlooked by beginners and even some experienced traders, tokenomics is the blueprint that defines how a token functions, creates value, and sustains its ecosystem. If you’re serious about investing or building in Web3, this tokenomics 101 guide is your essential starting point.

What Is Tokenomics?

Tokenomics (short for token economics) is the study of the design, structure, and functionality of a cryptocurrency’s token model. It includes everything from supply distribution and inflation mechanisms to utility, governance roles, and incentives.

At its core, tokenomics helps answer key questions:

- What gives a token value?

- How is that value sustained?

- How are users incentivized to hold, spend, or stake the token?

The answers to these questions determine whether a token is economically sound—or destined to crash.

Key Components of Tokenomics

1. Token Supply

Understanding how many tokens exist and how they’re distributed is vital. Most tokens outline three figures:

- Total supply: The number of tokens that will ever exist

- Circulating supply: The number of tokens currently in the market

- Maximum supply (or cap): The hard limit on how many tokens can be minted

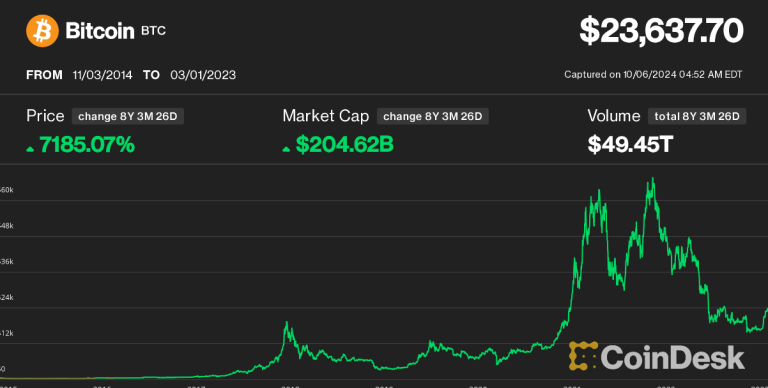

Tokens with capped supply (like Bitcoin’s 21 million) are often seen as deflationary, whereas tokens with no cap (or high inflation) may struggle to maintain long-term value.

2. Distribution Model

A fair and transparent distribution plan can boost investor confidence. Ask:

- How much goes to the team or early investors?

- Are there vesting schedules to prevent sudden dumps?

- How are community rewards allocated?

3. Utility

Utility is what gives a token real-world value. A strong token has use cases within its ecosystem, such as:

- Paying transaction fees (e.g., ETH)

- Staking for yield or governance

- Gaining access to features or services

Tokens without clear utility risk becoming “just another coin.”

4. Inflation and Deflation Mechanisms

Some projects burn tokens to reduce supply over time. Others issue new tokens through staking rewards or liquidity incentives. Understanding whether a token is inflationary or deflationary can inform your investment strategy.

Why Tokenomics Matters for Investors

Tokenomics isn’t just for developers or economists—it’s for anyone who wants to make informed decisions in crypto. Good tokenomics can:

- Support price stability

- Attract long-term users

- Prevent manipulation

- Encourage sustainable ecosystem growth

Poorly designed tokenomics, on the other hand, often lead to failed launches, price crashes, and user distrust.

Get Started with a Full Breakdown

Ready to dive deeper into supply mechanics, inflation strategies, and real-world examples? This detailed tokenomics 101 guide provides everything you need to understand and evaluate token models before you invest.

It’s the perfect resource for beginners and seasoned crypto enthusiasts alike.

Final Thoughts

In the crypto space, trends may come and go—but fundamentals always matter. Tokenomics is one of those key fundamentals. By learning how to analyze token structures, you can make smarter investment decisions, avoid common pitfalls, and identify truly valuable projects.

So before you buy into the next trending token, take a step back and study the economics behind it. Because understanding tokenomics isn’t just a skill—it’s your edge in a rapidly evolving market.